1041 capital loss carryover worksheet

Get And Sign 2019 Schedule D (Form 1041). Capital Gains And Losses. 8 Images about Get And Sign 2019 Schedule D (Form 1041). Capital Gains And Losses : Get And Sign 2019 Schedule D (Form 1041). Capital Gains And Losses, worksheet. Capital Loss Carryover Worksheet 2013. Grass Fedjp Worksheet and also Form 1041-N U.S. Income Tax Return for Electing Alaska Native.

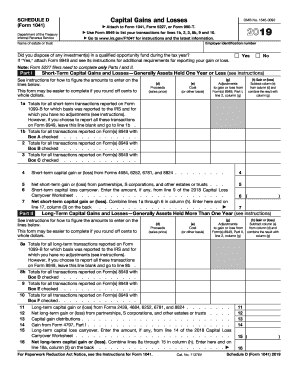

Get And Sign 2019 Schedule D (Form 1041). Capital Gains And Losses

www.signnow.com

www.signnow.com

1041 losses pdffiller irs signnow printable

TaxHow » You Win Some, You Lose Some. And Then You File Schedule D

taxhow.net

taxhow.net

schedule term capital loss lose win then file

Publication 908 (7/1996), Bankruptcy Tax Guide

www.unclefed.com

www.unclefed.com

bankruptcy

Updated Learning: Form 1041 Schedule D

updated-learning.blogspot.com

updated-learning.blogspot.com

tax schedule form forms deductions irs sole proprietorship freelance 1041 writer business learning updated writing taxes dummies income profit resume

Form 1041-N U.S. Income Tax Return For Electing Alaska Native

formupack.com

formupack.com

irs forms tax

Worksheet. Capital Loss Carryover Worksheet 2013. Grass Fedjp Worksheet

www.grassfedjp.com

www.grassfedjp.com

derivative calculus carryover differentiation tune

Capital Loss Carryover Worksheet | TUTORE.ORG - Master Of Documents

tutore.org

tutore.org

1041 carryover irs

Schedule D Tax Worksheet Continued | Printable Worksheets And

www.cutiumum.net

www.cutiumum.net

tutors families estimated

Tax schedule form forms deductions irs sole proprietorship freelance 1041 writer business learning updated writing taxes dummies income profit resume. Schedule term capital loss lose win then file. Form 1041-n u.s. income tax return for electing alaska native